Making money is the objective of each company. Not getting paid on time can drastically impact the success of your business. Setting the invoice payment terms and conditions is the key to maintaining a healthy cash flow for your company. It also reduces the chance of dispute if something goes wrong. If you fail to define the correct terms and conditions in writing from the start, you are much more likely to get late payments, poor cash flow and financial instability.

Late payment denotes the money that a company receives after the date the payment was supposed to arrive. Every company has faced late payments and our is no exception. You’re probably interested in minimizing your company’s loss. So, what are those discrepancies you need to know to be trading with other countries? Some payment terms or contact details that are peculiar to one country can be absolutely unacceptable to another.

Statistics show that more than half of payments are paid later than they were due. To avoid that some basic principles should be outlined in the contract:

– The time when you expect to be paid (within a week, month, etc. after the invoice has been received) and a date when payment is expected. Or your company may switch to net days.

– Payment methods (like bank transfer, PayPal, debit or credit cards, etc.) should be clearly outlined.

– The currency in which you would like to be paid in if your business trades with other countries.

– Late payment fees should also be discussed in advance.

– Any other possible payment details.

There are some standard terms when a company is supposed to receive the money starting from the date the invoice was issued. Though it depends on the country where your company is located, the industry you’re working in, and your preferences. You might even consider offering a certain discount

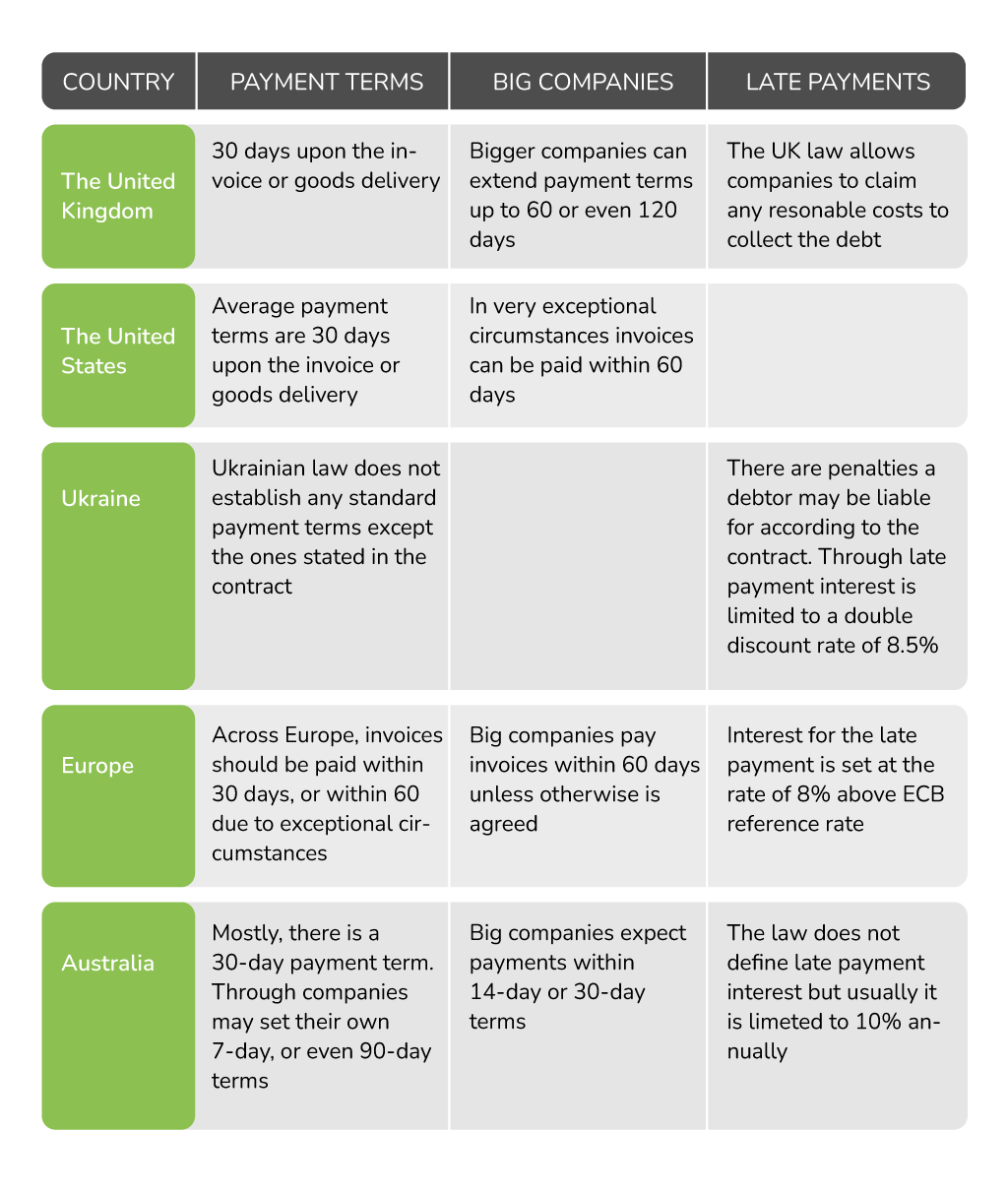

When you are trading with countries abroad, you are supposed to bear in mind that different countries establish their own payment terms.

Though companies often face late payments, there are some hacks to remedy the situation.

– If possible, offer a discount if a customer pays earlier.

– Online invoicing and other modern technologies to streamline payment processing.

– Payment processing and control, tracking payments, and notifying customers about payment terms are very important options. Don`t forget about that.

– Hire a VA who can quickly email invoices and speed up the payment process.

Our team of Virtual Assistants at VAfromEurope is ready to help you minimize or even eliminate those late payment issues thus allowing you to grow your business. Send us an email or give us a call to schedule a consultation or a meeting.