It’s no secret that outsourcing has become a common practice for many businesses in order to improve customer service, save on monthly expenses etc. The same goes with the banking sphere and other financial institutions, insurance companies. Nowadays, more and more companies tend to delegate basic back office and other processes like payment factory to third parties. This option allows companies to streamline and simplify those processes.

Banking business process outsourcing or Banking BPO is a special outsourcing strategy, which banks and lending institutions use to support an act of business acquisition, manage cash and investments, account servicing activity. Normally, banks and other institutions test the service by delegating minor tasks like application maintenance or finance accounting. Here, in the article we are discussing banks as an example, but the information is applicable to any kind of financial institution.

Mostly, these financial institutions prefer retaining any customer contact areas, but outbound sales are the exception. They are looking to push their new products to the market quicker and reduce initial capital outlay. So, here comes the opportunity for BPO services. In other words, BPO is the process of delegating some internal business processes to a third party.

Outsourcing for financial institutions has many benefits. In terms of ITO, this strategy makes sense, since banks, insurance companies and other lending institutions get access to the newest technology they can afford. Thus, companies can focus on their bigger plans. The process support requires a lot of attention and, thus, a huge amount of time and staff training.

The most common processes to be outsourced are server management, software development, network administration or cloud services. Actually, IT outsourcing or ITO is what most companies do nowadays. But what are the other services to be delegated to BPO?

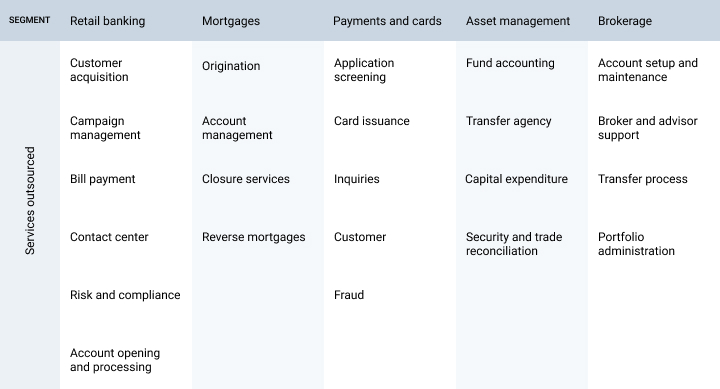

The financial industry mainly outsources services in the following segments: retail banking, brokerage, cards and payments, mortgages, asset management, analytics and research, as they are the core functions of any financial institution. Thus, focusing on it will significantly improve the customer service, fasten the speed to the market and improve banking product capabilities.

As banks grow, they build disparate systems for different operations, but outsourcing core services can ease growing pains by changing the operating model. So, the key benefits of its successful implementation are:

- Operational efficiency

- Customer intimacy

- Regulatory compliance

- Market agility

The main outsourced services across the banking BPO are:

- Call -Center (inbound calls, cold calling, dealing with complaints);

- Property valuation (when giving out loans), filing documents for loan contracts;

- Completing and checking loan documents;

- Accounting and finance, financial transactions and settlement;

- HR and Print-Mail Services;

- Payroll and payment processing;

- Product research and value assessment, marketing strategy and SMM;

- Logistics;

- Coordination of trade confirmations;

- Reconciling securities and account statements;

- Operation of netting systems ;

- Using salesforce to manage customer pipeline;

- Calling customers that are coming up to the end of their contacts and selling them insurance;

This table compares services in terms of departments:

Service providers are also leveraging their expertise in horizontal specific services such as:

- Supply Chain Management: strategic sourcing, supplier management,

- Procurement: order processing automation, process order tracking, electronic invoicing,

- Finance and accounting: financial analysis, procure to pay, accounts receivable/payable,

- Human Recourses outsourcing: payroll, learning solutions, administration, compensation and benefits,

- Research and Analytics: retail analytics, risk analytics, research support, marketing and customer analytics. Among these services, F&A remains the most popular, followed by procurement services.

These services can easily be automated to reduce the overall cost and improve service level. That is why financial institutions increasingly outsource these paper-intensive services in order to turn them into more automated and simplified processes.

No doubt, delegating tasks in the banking sector entails certain risks, because dealing with unreliable third parties might tarnish a company’s reputation. Financial institutions conduct extensive research before signing the agreement and choose trustworthy companies.

As we’ve mentioned before, outsourcing in the banking sphere has many advantages. So, have you ever considered taking these tasks off your staff’s plate to cut costs, improve customers’ experience and increase efficiency and security?